Managing payments with bad credit catalogues can be a challenging task for individuals looking to purchase goods on credit. Bad credit catalogues are a type of catalogues that offer credit to individuals with less than perfect credit scores. These catalogues can be a useful resource for those who are struggling to get approved for traditional credit options, but they also come with some unique challenges. One of the key impacts of managing payments with bad credit catalogues is the higher interest rates that are typically charged. Due to the higher risk associated with lending to individuals with bad credit, these catalogues often charge higher interest rates than traditional credit options. This can make it more difficult for individuals to pay off their balances and can lead to a cycle of debt if not managed carefully.

In addition to higher interest rates, managing payments with bad credit catalogues can also impact an individual’s credit score. Late or missed payments can have a negative impact on a person’s credit score, making it even more difficult to secure credit in the future. Despite these challenges, there are strategies that individuals can use to successfully manage their payments with bad credit catalogues. In the next section, we will discuss some key takeaways and tips for effectively managing payments with bad credit catalogues to help individuals navigate this challenging financial situation.

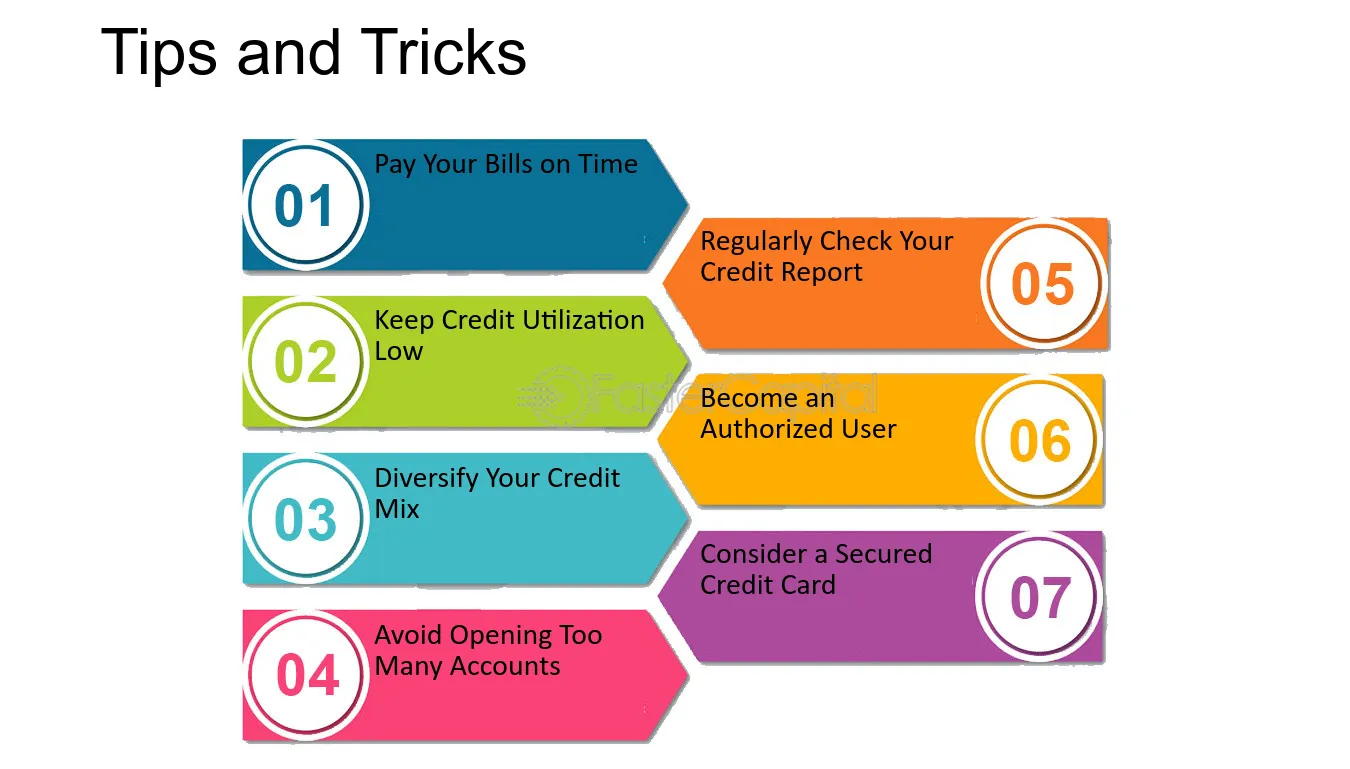

key Takeaways

1. Make timely payments to improve your credit score and avoid additional fees or penalties from the catalogue company.

2. Consider setting up automatic payments to ensure you never miss a payment, making it easier to manage your account.

3. Monitor your credit report regularly to track your progress and identify any errors or fraudulent activity that may affect your credit score.

4. Communicate with the catalogue company if you are experiencing financial difficulties to explore alternative payment options or negotiate a payment plan.

5. Utilize the catalogue company’s resources, such as budgeting tools and financial counseling services, to help improve your financial literacy and make more informed decisions regarding your payments.

How can you effectively manage payments with bad credit catalogues?

Understanding Bad Credit Catalogues

Bad credit catalogues are a great option for individuals with poor credit history who still want to shop for essentials. These catalogues allow customers to buy now and pay later in installments.

Tips for Managing Payments

1. Set a Budget: Before making any purchase, it’s important to set a budget and stick to it. This will help you avoid overspending and ensure you can make your payments on time.

2. Track Your Expenses: Keep track of all your purchases and payments to stay on top of your financial situation. This will help you avoid missing payments and accumulating additional fees.

3. Make Timely Payments: Always try to make your payments on time to avoid late fees and further damaging your credit score. Consider setting up automatic payments to ensure you never miss a due date.

4. Communicate with the Catalogue Company: If you’re facing financial difficulties and can’t make a payment, don’t ignore the issue. Reach out to the catalogue company and explain your situation. They may be able to offer a repayment plan or alternative solutions.

5. Improve Your Credit Score: Over time, work on improving your credit score by making timely payments and reducing your overall debt. This will eventually open up more financial opportunities for you.

Frequently Asked Questions

Can I still shop with bad credit?

Yes, you can still shop with bad credit by using bad credit catalogues that offer payment plans and options specifically designed for those with poor credit scores.

How can I improve my credit score while using a bad credit catalogue?

You can improve your credit score by making timely payments on your catalogue purchases. This demonstrates responsible financial behavior and can help boost your credit over time.

What happens if I miss a payment on a bad credit catalogue?

If you miss a payment, you may incur late fees or penalties. It’s important to communicate with the catalogue company and try to work out a repayment plan to avoid further negative impact on your credit.

Are there limits to how much I can spend with a bad credit catalogue?

Each catalogue may have different spending limits based on your credit history and payment history with the company. Be sure to check with the catalogue for specific details on spending limits.

What are the benefits of using a bad credit catalogue?

Using a bad credit catalogue can allow you to make purchases without the need for a good credit score. It can also help you rebuild your credit over time with responsible payment habits.

Can I return items purchased through a bad credit catalogue?

Most bad credit catalogues have return policies in place. Be sure to check with the catalogue company for their specific return policy and procedures.

Are there additional fees associated with using a bad credit catalogue?

Some bad credit catalogues may have additional fees such as account maintenance fees or processing fees. Be sure to read the terms and conditions carefully before making any purchases.

What should I do if I can’t make a payment on my bad credit catalogue?

If you are having difficulty making a payment, it’s important to contact the catalogue company as soon as possible. They may be able to work out a payment plan or provide guidance on other options.

How can I find reputable bad credit catalogues to shop with?

You can research online for reviews and recommendations from other customers who have used bad credit catalogues. It’s also a good idea to check with the Better Business Bureau for any complaints against the company.

Is it possible to build good credit with a bad credit catalogue?

Yes, it is possible to build good credit with a bad credit catalogue by making consistent, on-time payments and managing your account responsibly. Over time, your credit score may improve with this positive financial behavior.

Final Thoughts

Managing payments with bad credit catalogues can be a helpful tool for those looking to make purchases without a good credit history. By utilizing these catalogues responsibly and making timely payments, individuals have the opportunity to rebuild their credit over time. It’s important to stay informed of the terms and conditions of the catalogue to avoid any additional fees or penalties.

Remember, communication is key if you encounter any difficulties with payments. Reach out to the catalogue company for assistance and work together to find a solution that works for both parties. With diligence and responsible financial habits, managing payments with bad credit catalogues can be a positive step towards improving your credit standing.